How Often Should Real Estate Agents Follow Up With Leads?

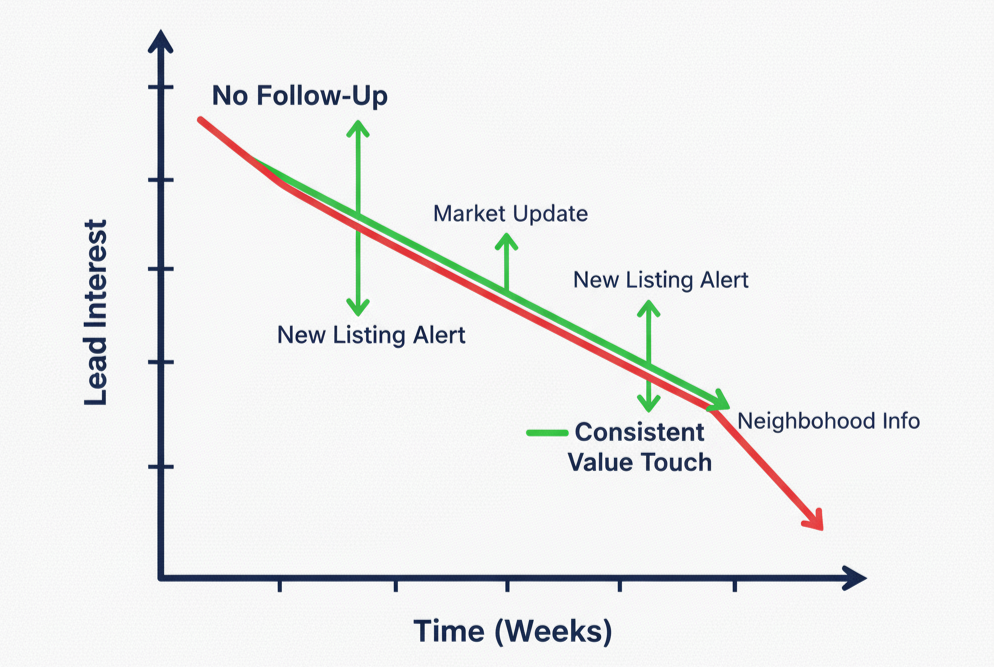

One of the most common questions solo real estate agents ask is also one of the hardest to answer clearly: How often should I follow up with leads without annoying them? Some agents worry they’re following up too much.Others stop too early because they don’t want to seem pushy. In reality, most agents don’t lose … Read more